Trading Signale

Klare Signale

In vielen Situationen ist es relativ einfach, die Richtung zu bestimmen, die ein Markt wahrscheinlich in der Zukunft einschlagen wird.

Aber wenn es um das Timing geht, d.h. um die Bestimmung des Zeitpunkts, wann man gezielt in den Markt eintritt und wann man ihn verlässt, geraten selbst erfahrene Profis in Schwierigkeiten.

Um eine solche Entscheidung zu treffen, können Sie auf alle möglichen Informationsquellen zurückgreifen, von Fundamentaldaten, technischen Indikatoren, Marktnachrichten,

Chart-Informationen, aber auch Ereignis-Astrologie wird manchmal von Händlern bei der Erstellung ihrer Prognosen verwendet, und all diese Informationen sind als Software oder im Internet verfügbar.

Kein Wunder, dass sich Händler in diesem Dschungel verloren fühlen. Es ist auch klar, wovon man in einer solchen Situation träumt; von einem Instrument, das einfach zu bedienen ist und zu einem sicheren Erfolg führt.

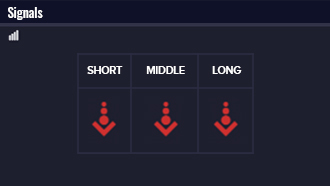

Wir bei adblue haben uns diesen Traum zur Aufgabe gemacht. Das Prinzip, das wir anwenden, ist die Übersetzung von nützlichen Informationen und Berechnungen in klare Signale,

die noch an jeden Handelsansatz angepasst werden können.

Das Analyse Modul

Aussagekräftige statt willkürliche Informationen

Die Zahl der Indikatoren für das Marktgeschehen ist unüberschaubar hoch. Sie beginnt bei einfachen technischen Indikatoren und Fundamentaldaten bis hin zu hochkomplizierten

mathematischen Formeln oder neuronalen Netzen. Die Palette der Analyse- und Indikationswerkzeuge ist so groß, dass ein Einzelner kaum den Überblick behalten kann.

Der einzelne Händler kann sich in der Vielfalt der Marktindikatoren mehr als verirren. Der Anwender findet es sehr verwirrend, den Zweck der einzelnen Instrumente zu entschlüsseln

und wann und warum sie für Händler nützlich sind. Bei adblue sind Trading-Ingenieure für Händler tätig. Und so stand die Interpretation von Marktindikatoren von Anfang an

auf unserer Tagesordnung.

Das Ziel, das wir uns bei der Entwicklung des TradeMaster® gesetzt haben, war es, die Marktindikatoren in die Software zu integrieren, so dass der Anwender nicht

einzelne Indikatoren oder Kombinationen von Indikatoren interpretieren muss, sondern klare Signale erhält, die er bei der Entscheidung für Long oder Short sofort nutzen kann.

Deshalb haben wir es uns zur Aufgabe gemacht, die Art der Signalgebung an den entsprechenden Handelsansatz anzupassen.

Mit dem TradeMaster® Analyse-Modul wurde ein Instrument geschaffen, das universelle Einsatzmöglichkeiten mit klaren Aussagen verbindet. Eine Vielzahl von alternativen Tools,

die so eingestellt werden können, dass eine optimale Signalgebung für Ihren individuellen Handelsansatz möglich ist - natürlich ohne Sie zu einer zusätzlichen Auswertung von Charts

zu zwingen.

Das PipVariometer

Zu wissen, dass Märkte sich bewegen, ist eine Sache. Um genau zu handeln, ist auch wichtig, die genaue Geschwindigkeit und das Momentum zu kennen, weshalb wir das PipVariometer

entwickelt haben. Pip wird verwendet, um die kleinste Einheit eines Instruments anzugeben.

“To pip” bedeutet auch, jemanden mit dem kleinstmöglichen Vorsprung zu schlagen. Dadurch wird der kleine Pip für Sie wichtig. Mit dem PipVariometer können Sie über ein

Dropdown-Menü drei verschiedene Instrumentenpaare gleichzeitig betrachten.

Das Trend Modul

Wie der Name schon sagt, ist dieses Instrument speziell darauf ausgerichtet, Hinweise auf Markttendenzen zu liefern:

Ähnlich wie beim Swing-Modul werden die Trends auf dem Markt visuell dargestellt.

Ein steigender blauer Balken deutet auf Aufwärtstrendphasen und ein fallender roter Balken auf einen Abwärtstrend hin. Der besondere

Der besondere Vorteil dieses Moduls ist die Angabe, wie lange ein Trend noch anhalten kann bzw. wie weit er bis zum

erwarteten Höhepunkt fortgeschritten ist.

"Der Trend ist dein Freund", sagt ein altes Trader Sprichwort. Der TradeMaster® kann Ihnen sagen, wie lange ein Trend anhalten könnte.

Diese beiden Module sind nur Beispiele für unsere einzigartigen Signalmodule, die wir in unserem TradeMaster® integriert haben und unseren Kunden kostenlos zur Verfügung stellen.

Josef-Orlopp-Str. 42

Josef-Orlopp-Str. 42 service@adblue.de

service@adblue.de +49

(0)30/ 243 42 -0

+49

(0)30/ 243 42 -0 +49 (0)30/ 243 42 -29

+49 (0)30/ 243 42 -29 www.adblue.com

www.adblue.com